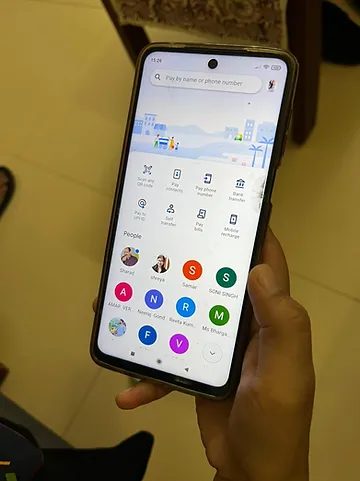

In today’s world, when we speak of making payments, what’s the first thing that comes to mind? Google Pay, Paytm, PhonePe etc, right? Well, that’s where the changing dynamics of financing comes into play. Rapidly expanding UPI has undoubtedly changed the face of payment ecosystem in India. Considered as a financial revolution, this instant-payment system with its hassle-free functions, enjoy a great consumer base and use in India. Incepted in 2016, as Unified Payment Interface, many SCBs, NBFCs and SFBs rapidly followed suit and launched their own versions of the digital payment system.

From vendors to normal people, from local grocery stores to shopping stores, UPI has overpowered and has spread its aura all over. Amongst the youth and the middle-aged population, UPI has increased its presence, even though people above 60, still prefer to make payments via cash. Within UPI, the two biggest players are PhonePe and Google Pay, with a market share of 46.3% and 36.4%, respectively. In an article by the Times of India, it was mentioned, “Launched in 2016, UPI has seen

tremendous adoption and crossed 1 billion transactions for the first time in October 2019. A year later in October 2020, UPI processed over 2 billion transactions, and in October 2021, it crossed $100 billion in value”, referring to the fact the growth of UPI is enormous and humongous. Surge in UPI transactions can be accounted to various factors of ease, safety, convenience etc. It keeps your money secured, as it provides with the option of keeping a safe passcode, which only the owner knows and have access to. It’s easy, since you no more have to worry about keeping change. When asked people about the advantages that UPI has bestowed upon them, Kashish, a college-goer, said, “I do not need to ponder upon the fact that I have to keep money with me, for making payments in college. I have Google Pay, which just takes me a few seconds to pay the amount. Thus, making this procedure for me smooth and effortless for me”. 26-year-old Rahul, a working professional, added, “Initially I used to have long-due payments with the tapri waala, but now I just G-Pay him, and all my payments are cleared on the spot”.

As widespread the use of UPI is, sometimes customers do face problems while making transactions, because we cannot deny the fact that a coin has two sides, therefore UPI has its positives and negatives. On one hand, “Monthly transaction volumes of UPI are likely to cross the 5-billion-mark, but have increasingly been facing glitches and failure rates, on the other hand”, in an article by the Indian Express. Users often face issues at certain times when online payments of their specific bank goes down, and in that case, they are left helpless, as some of them don’t carry cash because of UPI. There have also been instances when continuous payments are made because of some malfunction and the money gets delivered to other person, more than once. In such scenarios, UPI fails to address the issues sometimes then and there, but ultimately it gets resolved within 2-3 working days, or sometimes within a few hours. Although UPI can face issues, but the bottom line remains that it has made people independent, and somewhat reducing the chances of thefts and robbery.

UPI has been to the rescue with it’s ease of use. But one should not entirely depend on it and should make sure to carry some little amount of change in times, when UPI turns its back on you.